Thiamine Market to Reach USD 2.6 Billion by 2035, Driven by Nutrition & Pharma Growth Across APAC, Europe, USA & KSA

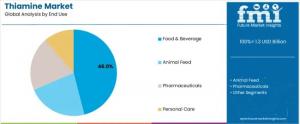

Mononitrate will dominate with a 68.0% market share, while food & beverage will lead the end use segment with a 46.0% share.

OSAKA CITY, OSAKA PREFECTURE, JAPAN, November 7, 2025 /EINPresswire.com/ -- The global thiamine (vitamin B1) market is entering a phase of strong, nutrition-driven expansion. Valued at USD 1.3 billion in 2025, the market is forecast to reach USD 2.6 billion by 2035, growing at a CAGR of 7.3%, according to the latest industry assessment. Demand is propelled by the rising adoption of fortified foods, dietary supplements, and preventive healthcare, as well as government-led nutrition programs and the increasing use of thiamine in pharmaceuticals and personal care.

Asia-Pacific Leads Global Growth with Strong Government Fortification Programs

The Asia-Pacific (APAC) region is emerging as the fastest-growing thiamine market, driven by large-scale fortification initiatives, increasing disposable income, and the expansion of the dietary supplement industry.

- India is expected to record a CAGR of 13% from 2025 to 2035, supported by the National Food Security Act, which mandates fortification of staple foods such as rice and wheat flour with vitamin B1. The Indian Council of Medical Research (ICMR) projects the domestic dietary supplement market to grow at 12.5% CAGR, boosting vitamin B1 usage in preventive nutrition products.

- China, which holds over 80% of the East Asia market share, will see a 12.4% CAGR by 2035, reaching approximately USD 620 million. Thiamine’s application in anti-aging skincare products is rapidly expanding. Beauty brands like Pechoin and Inoherb have launched vitamin B1-infused creams and serums to meet the surging demand for antioxidant-rich cosmetics.

Review the full report to examine in-depth market dynamics, strategic developments, and growth opportunities across key regions! Request Sample Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-15349

Japan and South Korea follow closely, with CAGRs of 6.9% and 11.9% respectively, supported by the growing consumption of energy drinks, fortified foods, and pharmaceutical-grade supplements among aging populations.

Europe Expands with Focus on Personal Care Innovation and Regulatory Strength

Europe is projected to capture 27% of global thiamine consumption by 2035, underpinned by robust R&D in personal care and nutrition sectors.

- In the United Kingdom, vitamin B1-enriched skincare and haircare products are driving growth. Leading brands such as Emma Hardie and Unilever are integrating thiamine into serums and shampoos to promote cellular regeneration and scalp health.

- Germany and France continue to dominate food fortification programs, with vitamin-enriched cereals, bread, and beverages widely consumed.

- European Food Safety Authority (EFSA) guidelines ensure consistency in formulation, stability, and labeling, making the region a benchmark for quality-driven thiamine manufacturing.

With BASF SE expanding thiamine production assets and DSM Nutritional Products scaling its Shanghai-based facility to supply European and Asian markets, Europe remains a center of both production excellence and innovation in functional nutrition.

United States Strengthens Nutritional Supplement Leadership

The U.S. thiamine market is poised for steady expansion, holding a CAGR of 2.9% through 2035 and commanding a significant 22% share of global revenues.

Growth is driven by long-established fortification practices, such as vitamin B1-enriched cereals and bread, and the rising preference for clean-label, nutritionally complete food products.

The National Institutes of Health (NIH) estimates that up to 80% of chronic alcohol consumers face thiamine deficiency risks, prompting higher adoption of over-the-counter supplements and clinical formulations to combat Wernicke-Korsakoff syndrome and related deficiencies.

Industry giants like Archer Daniels Midland (ADM) and Kemin Industries are expanding domestic thiamine production to meet the surging demand from nutraceutical and pharmaceutical sectors.

Saudi Arabia and the GCC: Emerging Nutraceutical Manufacturing Hub

The Middle East, led by Saudi Arabia, is building momentum as a growing market for thiamine-based fortified foods and supplements.

The region’s Vision 2030 initiative emphasizes self-reliance in pharmaceutical and food ingredient production, prompting partnerships between local firms and international nutrition leaders.

Saudi Arabia’s fortified flour and rice programs are projected to expand the country’s vitamin premix import and blending capacity by 40% by 2030.

The GCC region’s CAGR of 7.1% reflects rising public health awareness, increased government fortification mandates, and strategic investments in nutraceutical manufacturing zones.

Mononitrate Dominates with 68% Market Share in 2025

By product type, thiamine mononitrate will account for 68% of global market revenue in 2025, expanding to 80.4% by 2035.

Its superior stability, solubility, and shelf life make it the preferred form in both fortified foods and pharmaceutical formulations.

Manufacturers value its ability to withstand processing stress during baking, extrusion, and thermal fortification while maintaining potency, enabling its widespread adoption in cereals, beverages, and dietary supplements.

Food & Beverage Segment Leads End-Use Market with 46% Share

The food & beverage industry remains the largest consumer of thiamine, holding 46% of global revenues in 2025 and projected to reach 55.3% by 2035.

Thiamine fortification in cereals, energy drinks, dairy products, and bakery goods is increasing globally, supported by government mandates and consumer awareness.

- In India and Southeast Asia, government-backed nutrition programs have fortified millions of tons of rice and flour annually.

- In North America, fortification has been standard since the 1940s, helping reduce deficiency-linked disorders.

The functional beverage sector is emerging as a high-growth niche, integrating thiamine into energy shots and ready-to-drink health beverages, with manufacturers emphasizing natural vitamin sources and clean-label transparency.

Acquire the complete report to access detailed projections, country-level insights, company share assessments, and technology outlooks! Buy Full Report: https://www.futuremarketinsights.com/checkout/15349

Tablets & Capsules Form Lead with 41% Revenue Share

Among dosage forms, tablets and capsules represent 41% of total revenues in 2025, favored for portability, precise dosing, and extended shelf life.

Pharmaceutical and nutraceutical manufacturers are introducing controlled-release formulations to enhance bioavailability and patient adherence.

Continuous innovation in coating, taste-masking, and absorption technology is expected to sustain dominance of solid dosage forms through 2035.

Key Growth Drivers and Market Trends

- Rising Nutritional Awareness: Global education on metabolic health is driving thiamine supplement demand, especially in urban APAC and North America.

- Health-focused Consumer Behavior: IFIC (2025) survey shows 65% of consumers now actively seek fortified foods for wellness.

- Increasing Deficiency-related Disorders: WHO reports continued prevalence of beriberi and Wernicke-Korsakoff syndrome in Southeast Asia and Africa, prompting mandatory vitamin B1 fortification.

- Expanding Personal Care Use: Thiamine’s antioxidant and anti-aging benefits are boosting inclusion in skincare and haircare formulations, especially in China and the UK.

Competitive Landscape

The global thiamine market remains moderately fragmented, with a mix of multinational and regional players.

Tier 1 companies, including DSM-Firmenich, BASF SE, and Huazhong Pharmaceutical, control around 25% of total share due to their R&D capabilities, large-scale production, and strong regional presence.

Tier 2 players such as Lonza Group, Brother Enterprises, and Zhejiang NHU focus on specialized formulations and regional markets, while smaller Tier 3 firms cater to localized demand across emerging economies.

Recent developments include:

- ADM announcing a new thiamine production facility in North America (2025).

- Kemin Industries acquiring a South American producer to expand micronutrient supply.

- DSM establishing a new manufacturing unit in Shanghai to meet Asian demand.

- BASF SE enhancing European thiamine output capacity to strengthen supply reliability.

Future Outlook (2025–2035)

From 2025 to 2035, the thiamine industry is set to double in size, fueled by advances in fortification science, nutraceutical innovation, and regulatory alignment across regions.

The market’s semi-annual growth rate will range between 6.6% and 7.9%, reflecting consistent upward momentum.

With the convergence of public health policy, functional food innovation, and preventive healthcare trends, thiamine is cementing its position as a cornerstone of global nutritional wellness.

Exploring Insights Across Emerging Global Markets:

Coal Tar Pitch Market: https://www.futuremarketinsights.com/reports/coal-tar-pitch-market

Decorative Plastic and Paper Laminates Market: https://www.futuremarketinsights.com/reports/decorative-plastic-paper-laminates-market

Isoprene Rubber Latex Market: https://www.futuremarketinsights.com/reports/isoprene-rubber-latex-market

Aircraft Cleaning Chemicals Market: https://www.futuremarketinsights.com/reports/aircraft-cleaning-chemical-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why Choose FMI: Empowering Decisions that Drive Real-World Outcomes: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.