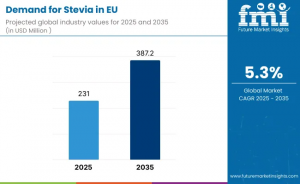

European Union Stevia Market Forecast USD 387.2 million by 2035: Natural Sweetener Demand to Surge

The European stevia market is poised for strong growth, driven by rising consumer preference for natural, low-calorie sweeteners.

NEWARK, DE, UNITED STATES, November 7, 2025 /EINPresswire.com/ -- The European Union stevia market is poised for robust expansion, with sales projected to grow from USD 231.0 million in 2025 to approximately USD 387.2 million by 2035, reflecting an absolute increase of USD 154.5 million. This represents a total growth of 66.9%, driven by rising consumer preference for natural, zero-calorie sweeteners and increasing regulatory pressure on sugar reduction. The market is expected to expand at a compound annual growth rate (CAGR) of 5.3% over the forecast period.

Market Drivers and Demand Trends

Between 2025 and 2030, EU stevia sales are forecast to increase from USD 231.0 million to USD 297.6 million, contributing 43.1% of the total decade-long growth. The surge is attributed to:

• Rising consumer health consciousness and demand for natural sweeteners.

• Regulatory initiatives encouraging sugar reduction across food and beverages.

• Mainstream adoption of stevia in beverages, bakery items, and tabletop sweeteners.

From 2030 to 2035, the market will further expand to USD 387.2 million, adding USD 87.9 million (56.9% of total growth). This growth phase is expected to be shaped by:

• Increased adoption of liquid stevia formats.

• Blended sweetener systems for improved taste and functionality.

• Innovative applications across dairy, confectionery, and snacks.

Historical Context

Between 2020 and 2025, the EU stevia market grew from USD 178.8 million to USD 231.0 million at a CAGR of 5.3%, fueled by:

• Rising obesity and diabetes prevalence prompting sugar alternatives.

• Growing consumer awareness of stevia’s natural, zero-calorie benefits.

• Product innovations improving taste profiles and reducing bitter aftertaste.

Product Type Insights

The powder extract format dominates, accounting for 60% of the market in 2025, declining slightly to 58% by 2035. Powder extract remains the preferred choice due to:

• Functional versatility and shelf stability.

• Ease of storage, transport, and formulation in industrial applications.

• Broad applicability in beverages, bakery, dairy, and tabletop products.

Liquid and leaf formats are gaining traction, particularly in beverage applications, reflecting evolving consumer and manufacturer preferences.

Application Segments

Beverages account for 35% of total sales in 2025, expected to grow to 36% by 2035. This dominance is driven by:

• Sugar reduction mandates encouraging product reformulation.

• Consumer preference for naturally sweetened drinks.

• Strong adoption by major beverage players across carbonated drinks, functional beverages, and dairy-based drinks.

Distribution Channels

The B2B/ingredients segment holds 62% market share in 2025, slightly declining to 60% by 2035. B2B remains critical for:

• Supplying bulk stevia with consistent quality.

• Technical formulation support for manufacturers.

• Ensuring reliable ingredient availability across food and beverage sectors.

Nature of Products

Conventional stevia accounts for 90% of sales in 2025, declining to 86% by 2035. The shift reflects:

• Increasing adoption of organic and unconventional products.

• Premium consumer preferences for sustainable, certified natural sweeteners.

Regional Demand Analysis

• Germany: 5.1% CAGR; largest market share (28.6%) with strong health awareness.

• Spain: 5.7% CAGR; rapid growth driven by wellness-focused beverage reformulation.

• France & Italy: 5.5% CAGR each; health trends and food innovation fueling demand.

• Netherlands: 5.4% CAGR; progressive consumer attitudes and retail support.

• Rest of Europe: 5.0% CAGR; consistent expansion across smaller markets.

Competitive Landscape

EU stevia is dominated by global and specialized producers:

• Roquette: 22% share, leveraging ingredient expertise and technical support.

• Ingredion (PureCircle): 18% share, specializing in glycoside optimization and taste innovation.

• Tate & Lyle: 14% share, known for hybrid sweetener blending and formulation support.

• Cargill: 12% share, focusing on agricultural integration and taste modulation.

• ADM: 8% share, delivering integrated ingredient solutions.

Other regional and niche players constitute 26% of the market, offering opportunities for differentiation via taste optimization, organic certifications, and technical support.

To Explore Detailed Market Data, Segment-Wise Forecasts, and Competitive Insights, Request Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27118

For Customized Insights And Licensing Options, Get The Full Report. Purchase Full Report. https://www.futuremarketinsights.com/checkout/27118

Key Trends and Innovations

• Taste Optimization: Rebaudioside enrichment and glycoside profiling are reducing bitter aftertaste, making stevia a mainstream sugar alternative.

• Blended Systems: Hybrid formulations combining stevia with sugar or other sweeteners improve taste and calorie reduction.

• Liquid Formats: Adoption of liquid stevia in beverages enables precise dosing, faster mixing, and consistent sweetness.

The EU stevia market is set to continue its steady growth, supported by evolving consumer health priorities, regulatory compliance, and innovative product development, positioning stevia as a core ingredient in natural sweetener adoption across Europe.

Browse Related Insights

Stevia Market: https://www.futuremarketinsights.com/reports/global-stevia-market

Steviacane Market: https://www.futuremarketinsights.com/reports/steviacane-market

Why FMI: https://www.futuremarketinsights.com/why-fmi

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.